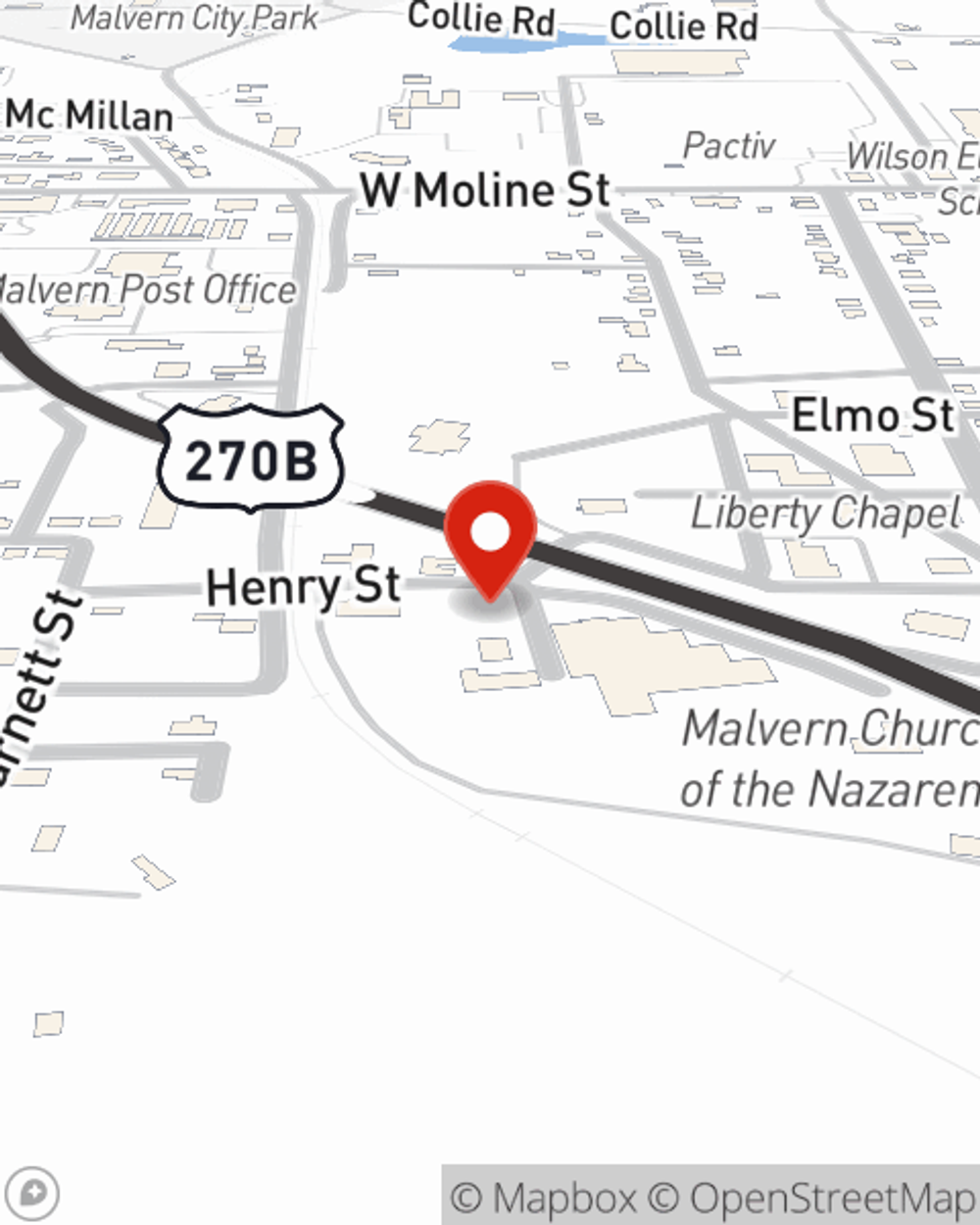

Business Insurance in and around Malvern

One of the top small business insurance companies in Malvern, and beyond.

Almost 100 years of helping small businesses

- Malvern

- Hot Spring County

- Magnet Cove

- Glen Rose

- Poyen

- Prattsville

- Donaldson

- Bismarck

- Rockport

- Jones Mill

- Social Hill

- Antioch

- Hot Springs

- Benton

- Fountain Lake

- Mountain Pine

- Haskell

- Salem

- Traskwood

- Sheridan

- Leola

- Grant County

- Carthage

- Arkadelphia

Help Protect Your Business With State Farm.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a staff member gets hurt on your property.

One of the top small business insurance companies in Malvern, and beyond.

Almost 100 years of helping small businesses

Cover Your Business Assets

Planning is essential for every business. Since even your most detailed plans can't predict consumer demand or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like a surety or fidelity bond and worker's compensation for your employees. Terrific coverage like this is why Malvern business owners choose State Farm insurance. State Farm agent Monica Yarbrough can help design a policy for the level of coverage you have in mind. If troubles find you, Monica Yarbrough can be there to help you file your claim and help your business life go right again.

Don’t let worries about your business keep you up at night! Contact State Farm agent Monica Yarbrough today, and see how you can meet your needs with State Farm small business insurance.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Monica Yarbrough

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.